Global AgriTech Market Size & Share Analysis – Growth Opportunity Trends & Forecasts (2024 – 2029)

The Global AgriTech Market is Segmented By Type (Big Data and Analytics, Biotechnology and Biochemical, Mobility, Sensors and Connected Devices and Others), By Application (Crop Production, Livestock Farming, Aquaculture and Forestry Management), By Sector (Precision Farming, Agriculture, Agrochemicals, Smart Agriculture, Biotechnology, Indoor Farming and Others) and By Region (North America, Europe, Asia-Pacific, Latin America and Middle East and Africa). The report offers market size and forecasts for the global agritech market are provided in terms of value (USD) for all the above segments.

Market Overview:

The Global AgriTech Market size is estimated at USD 18.24 billion in 2024 and is expected to reach USD 43.37 billion by 2029, growing at a CAGR of 16.63% during the forecast period (2024-2029).

The Agriculture Market is expanding rapidly due to the increased usage of innovative technologies in the agriculture sector. The integration of numerous digital solutions, such as precision farming, remote sensing, and IoT devices, has transformed agricultural methods. These tools enable farmers to monitor crop conditions, optimize irrigation systems, and effectively manage resources.

Furthermore, rising global population and food demand have prompted the use of novel farming practices to increase productivity and sustainability. Farmers benefit from smart agriculture in a variety of ways, including increased production, decreased waste, more effective resource usage, and higher profitability. Furthermore, government support for improving agricultural techniques is fuelling market expansion. Various programs, such as subsidies for smart agricultural tools and equipment, are pushing farmers to use this technology.

The worldwide urge to feed a growing population is driving the development of Agritech solutions to improve agricultural productivity and efficiency. Climate change and sustainability issues encourage eco-friendly and resilient farming practices, which align with Agritech solutions.

This agricultural technological innovation employs big data to improve management decisions, allowing farmers to optimize crop yield by controlling variables such as moisture level, soil condition, and microclimates. It uses remote sensing technologies, drones, robotics, and automation to improve crop health and maximize agricultural resources, resulting in higher productivity.

Agritech’s automation and robotics capabilities help to alleviate labor shortages, while government subsidies and legislation encourage farmers to engage in technology adoption. Consumer demand for food supply chain transparency drives the deployment of blockchain and traceability technologies.

Market Trends:

Market Trend 1: The growing adoption of precision agriculture serves as a key driver for market growth

The precision agriculture industry is expanding rapidly, driven by increased demand for optimum farming solutions and sustainable practices. Key market drivers include technology developments in IoT, AI, and remote sensing, as well as an increasing emphasis on resource efficiency and crop production improvement. Market penetration is increasing, notably in developed regions, while usage is growing in emerging economies. The primary focus is on integrating cutting-edge technologies to increase farm production and sustainability. High prices and technological complexity make widespread adoption difficult, particularly for smallholders. However, the market’s potential is enormous, with several prospects for innovation and expansion within the global agricultural scene.

The growing use of precision agriculture is a major driver of growth in the Agritech industry. Precision agriculture is the practice of monitoring and managing field variability in crops and livestock using advanced technology such as GPS, IoT sensors, and data analytics. This strategy enables farmers to optimize inputs like water, fertilizer, and pesticides, resulting in more efficient and sustainable farming operations.

Precision agriculture provides a solution for farmers faced with the simultaneous difficulties of rising operational expenses and the requirement to provide more food for a growing population. This technology assists farmers in increasing agricultural yields, reducing waste, and minimizing environmental impact by allowing them to make data-driven decisions. The ability to accurately allocate resources based on real-time data leads to increased productivity and cost savings.

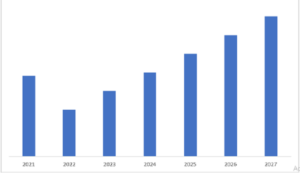

Forecast market value of precision agriculture worldwide, in USD Billion from 2021 to 2027

Market Trend 2: North America is expected to dominate the Global AgriTech Market

The North American region is expected to account for the greatest part of the worldwide agritech market, owing to the continued contribution of tech titans to technical advancements and market competitors’ increasing proclivity to engage in mergers and acquisitions.

The region benefits from a strong research and development environment, which includes various agricultural research facilities and universities that promote innovation. Significant venture capital investments in AgTech firms drive growth, which is aided by government funding through a variety of federal and state initiatives that encourage agricultural research and technology use.

Tech hubs and agritech incubators, which stimulate innovation and attract talent and finance to the sector, are particularly prevalent in Silicon Valley and the Midwest. Large-scale commercial farming enterprises were among the first to use agritech in the region. These companies use precision agriculture technologies, big data analytics, and sophisticated gear to boost crop yields, cut costs, and improve sustainability.

Precision agriculture usage is driving the regional market expansion. Precision agriculture technology, including as drones, sensor-based systems, and GPS-guided tractors, has gained widespread use in North America. Using this technology, farmers can maximize crop yields while lowering input costs and increasing total farm production.

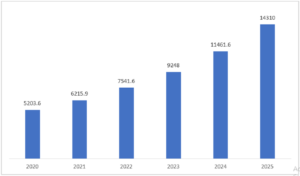

Agricultural technology (Agtech) market value in North America from 2020 to 2025, valued in USD Million

Competitive Landscape:

The Agritech market is largely fragmented due to its diversity and the presence of numerous players, certain segments may experience consolidation as larger companies seek to strengthen their competitive positions. This dynamic creates a competitive landscape where innovation thrives, but it also presents challenges for smaller firms to scale and compete effectively.

During the study period, market companies are also engaged in mergers and acquisitions, and alliances are aimed at increasing their market share. During the forecast period, the market has growth opportunities, which are expected to increase competition. However, as a result of product innovation and technical advancement, mid-size to small enterprises are extending their market presence by winning new contracts and entering previously unexplored markets are among the global market’s major players. To acquire a competitive advantage over their rivals, the corporations are working on a variety of strategic activities such as new product development, partnerships, collaborations, and agreements.

Major Players:

- Bayer AG

- Corteva Agriscience

- Syngenta

- Trimble Inc.

- AG Leader Technology

- Deere & Company (John Deere)

- Indigo Agriculture

- Farmer’s Edge

- Grower’s Edge

- Nutrien

Recent Developments:

- In March 2024, Corteva, Inc. has announced the introduction of Corteva Catalyst, a new investment and collaboration platform aimed at acquiring and bringing to market agricultural technologies that advance the company’s R&D priorities and generate value. Corteva Catalyst will collaborate with entrepreneurs and innovators to expedite the development of breakthrough early-stage technologies that will allow farmers to produce more food and feed on a sustainable basis.

- In February 2024, Syngenta Group, one of the world’s top agricultural technology businesses, announced significant agreements after the introduction of its innovation accelerator platform, Shoots by Syngenta, in 2023. These alliances, which bring together experts from several businesses and sectors, aim to accelerate the development of creative solutions to agricultural difficulties.

- In February 2023, ForGround by Bayer has announced the addition of three new companies to its growing network of resources and expertise to assist farmers in successfully adopting and implementing regenerative agriculture practices: Great Plains Ag, Sound Agriculture, and EarthOptics. These innovative enterprises can assist farmers in gaining insights, additional benefits, and resources, allowing them to accelerate and embrace new techniques.

1. INTRODUCTION

1. 1.1 Study Assumptions and Market Definition

2. 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 Growing demand for food security and sustainability

4.2.2 Relentless population growth and the pressures of climate change are also driving the adoption of agritech solutions

4.3 Market Restraints

4.3.1 Restricted Access to Technology in Rural and Remote Regions

4.3.2 Significant Upfront Costs for Implementing Technology

4.4 Market Opportunities

4.4.1 Incorporation of AI and Machine Learning for Forecasting Analytics

4.4.2 Collaboration with Agri-Food Startups for Disruptive Innovations

4.5 Porter’s Five Forces Analysis

4.5.1 Threat of New Entrants

4.5.2 Bargaining Power of Buyers/Consumers

4.5.3 Bargaining Power of Suppliers

4.5.4 Threat of Substitutes

4.5.5 Intensity of Competitive Rivalry

4.6 Insights on Technological Innovations in the Market

4.7 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

5.1 By Type

5.1.1 Big Data and Analytics

5.1.2 Biotechnology and Biochemical

5.1.3 Mobility

5.1.4 Sensors and Connected Devices

5.1.5 Others

5.2 By Application

5.3.1 Crop Production

5.2.2 Livestock Farming

5.2.3 Aquaculture and Forestry Management

5.3 By Sector

5.3.1 Precision Farming

5.3.2 Agriculture

5.3.3 Agrochemicals

5.3.4 Smart Agriculture

5.3.5 Biotechnology

5.3.6 Indoor Farming

5.3.7 Others

5.4 By Region

5.4.1 North America

5.4.2 Europe

5.4.3 Asia-Pacific

5.4.4 Latin America

5.4.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Market Concentration

6.2 Company Profiles

6.2.1 BlackRock

6.2.2 Vanguard Group

6.2.3 State Street Global Advisors

6.2.4 Morgan Stanley Investment Management

6.2.5 JP Morgan Asset Management

6.2.6 Schroders

6.2.7 Goldman Sachs Asset Management

6.2.8 Amundi

6.2.9 PIMCO

6.2.10 Impax Asset Management

*List Not Exhaustive

7. MARKET FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

Request Sample Here

Request for Customized Report Here